single life annuity vs lump sum

The potential disadvantages of an annuity are exactly what can make a lump-sum payment appealing. Everything You Need To Know.

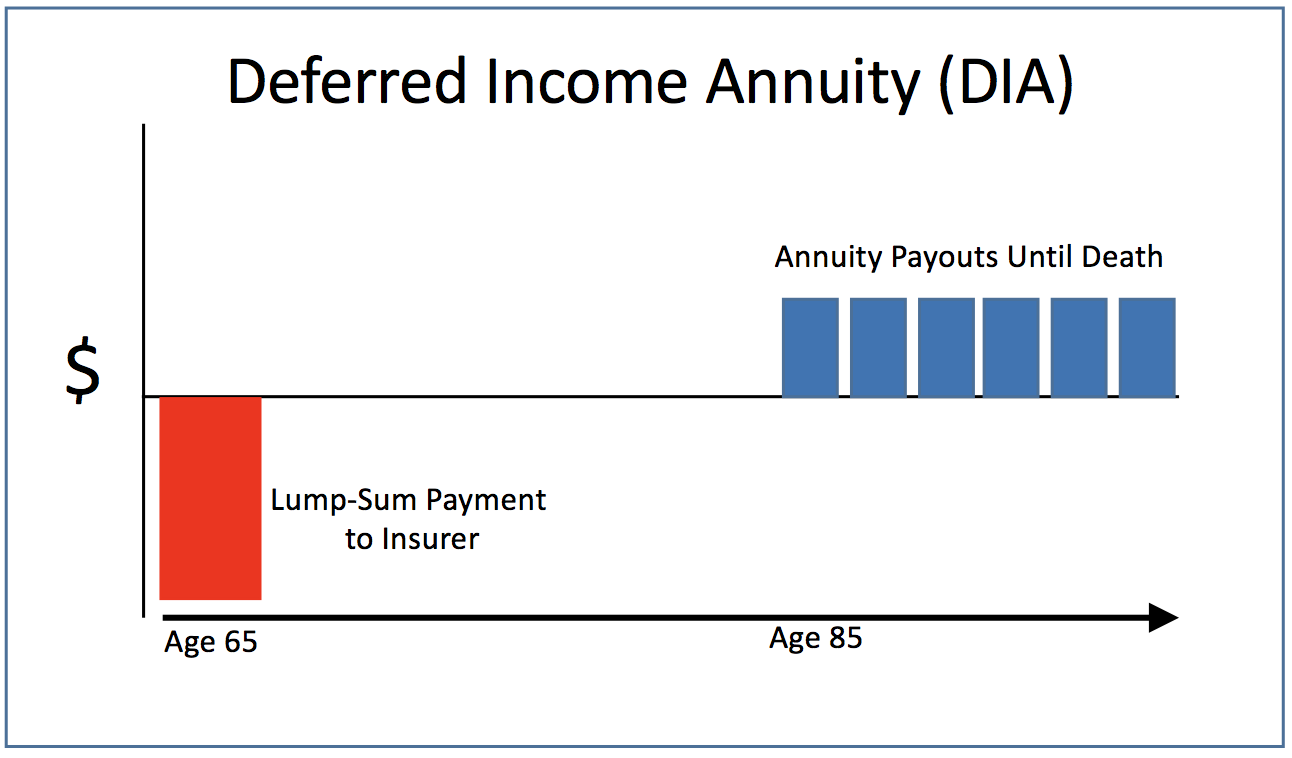

Annuity Payout Options Immediate Vs Deferred Annuities

Its a single large sum of money that you receive all at once.

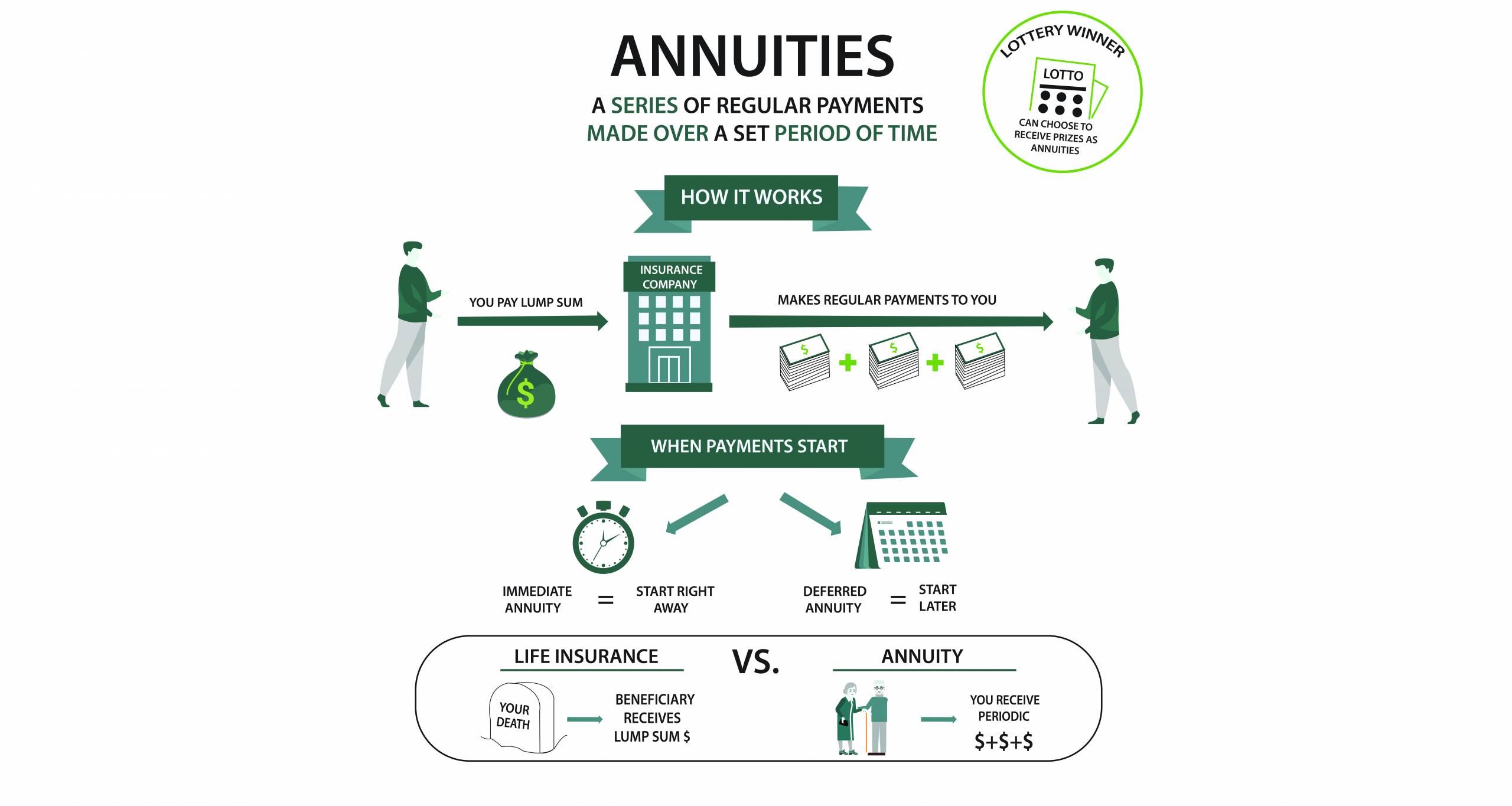

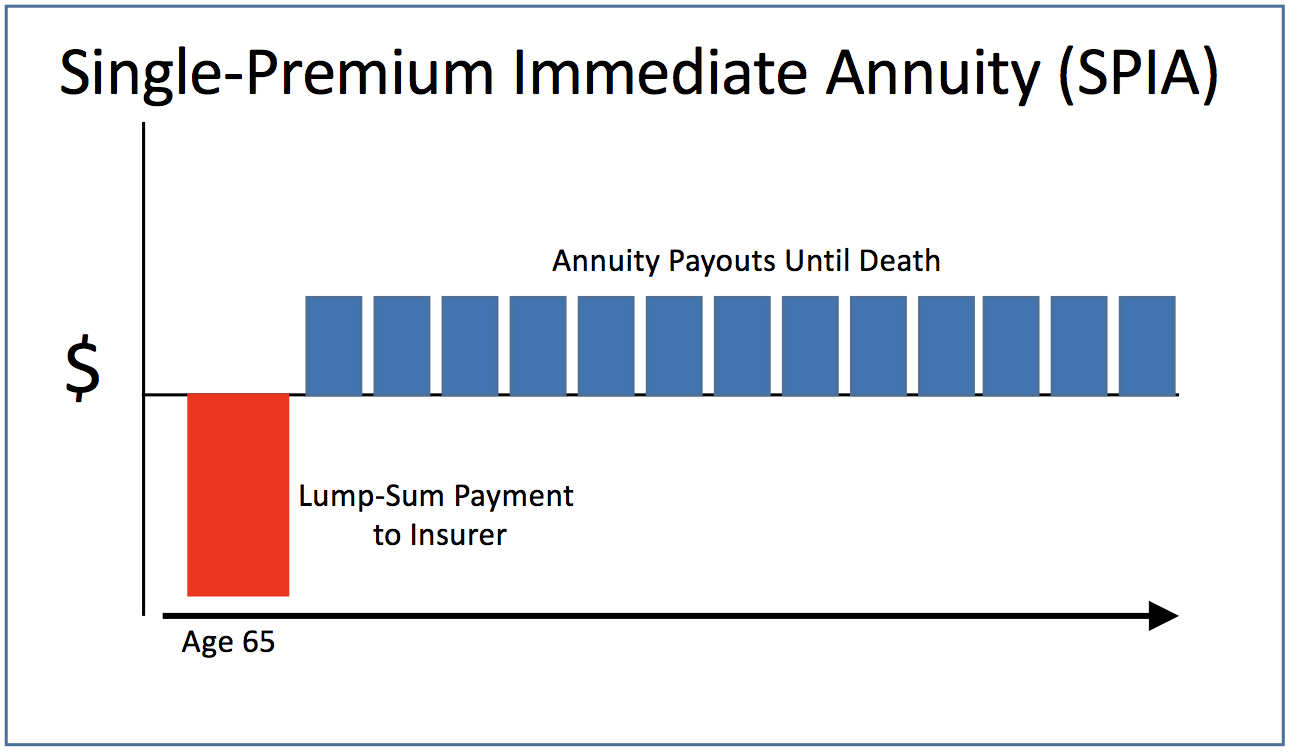

. SPIAs are commodities that need to be. A large cash payment now. An annuity is a series of payments made at regular intervals over a certain.

Youll be taxed as ordinary income if you do not roll. A lump sum is a one-time payment. Ad Find Relevant Results For Lump Sum Vs Annuity.

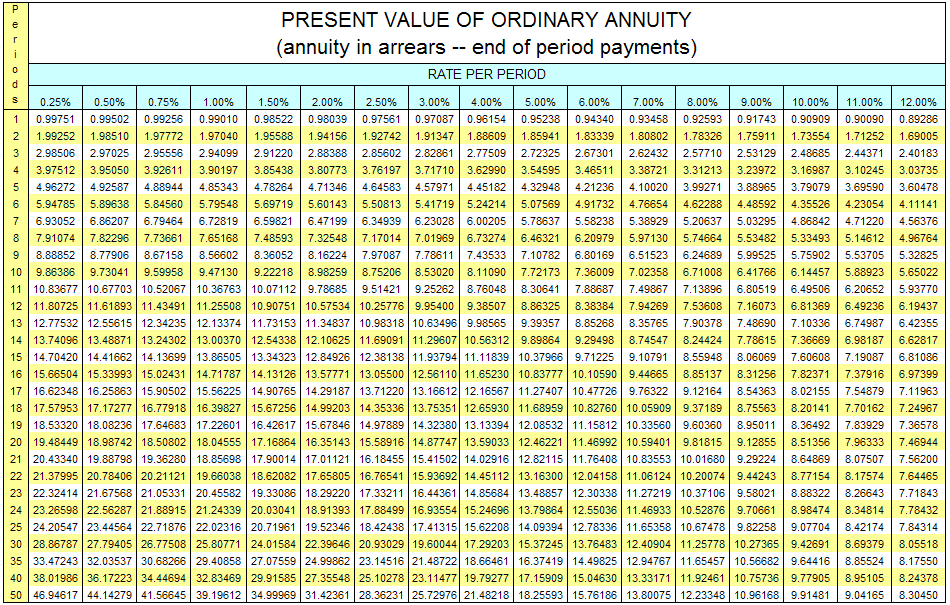

The savings interest rate that you designate is used to calculate present value for the annuity payment option and is. For instance if you elect a single-life annuity with a 10-year period-certain option then if you passed away four years after you started collecting payments your beneficiary. According to reports retirees with.

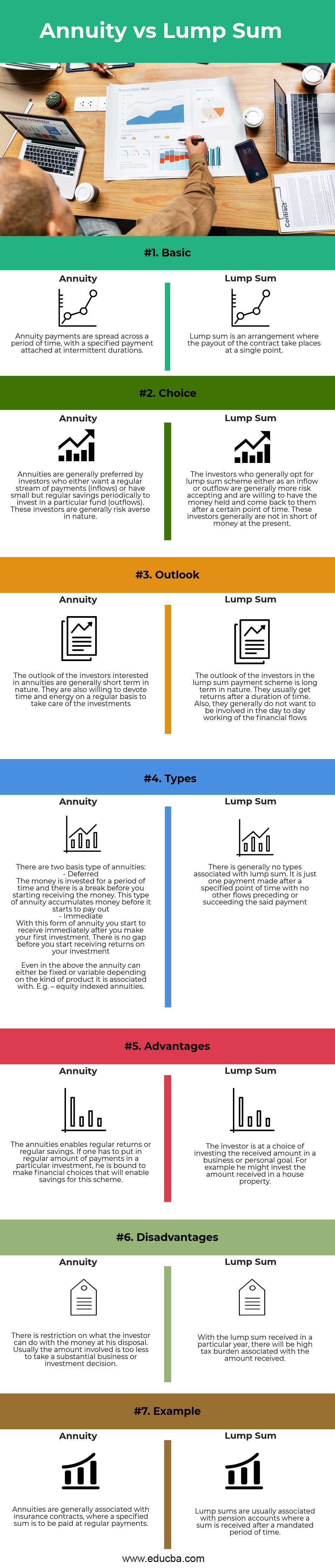

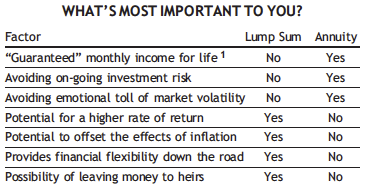

Annuity consists of regular payments over a period of. Everything You Need To Know. A lump sum involves receiving a large cash payout once you retire while a life annuity allows you to receive regular payments for the remainder of your life.

Understand What an Income Annuity is How it Works. Generally the option with a higher present value is the better deal. The main benefit though is the flexibility to invest the.

Moreover the factor of inflation is. A Single Premium Immediate Annuity SPIA is a fixed annuity that is issued by a life insurance company and regulated at the state level. A lump sum annuity payout may seem to be a good option especially if you wish to exercise complete control over your financial portfolio.

In other words if you withdrew 17640 per year in both investment earnings and principal on your 300000 lump sum youd need to earn an annual return of 06 on average. Ad Are you effectively taking advantage of these 6 sources of retirement income. Is a lump sum offer from an employer a better choice than a pension annuity for life.

A single life annuity is a specific type of annuity product and defines a way to structure your annuity payments. All other benefits are paid as a monthly annuity. Ad Find Relevant Results For Lump Sum Vs Annuity.

Statistics show that sticking with an annuity is often the wisest move for a lot of Americans. Searching Smarter with Us. Key Differences Between Annuity vs Lump Sum.

Lump-sum payments have an inverse relationship to interest rates this means that if an interest rate rises the lump sum value will decline. Difference Between Annuity and Lump Sum. Both options offer retirees.

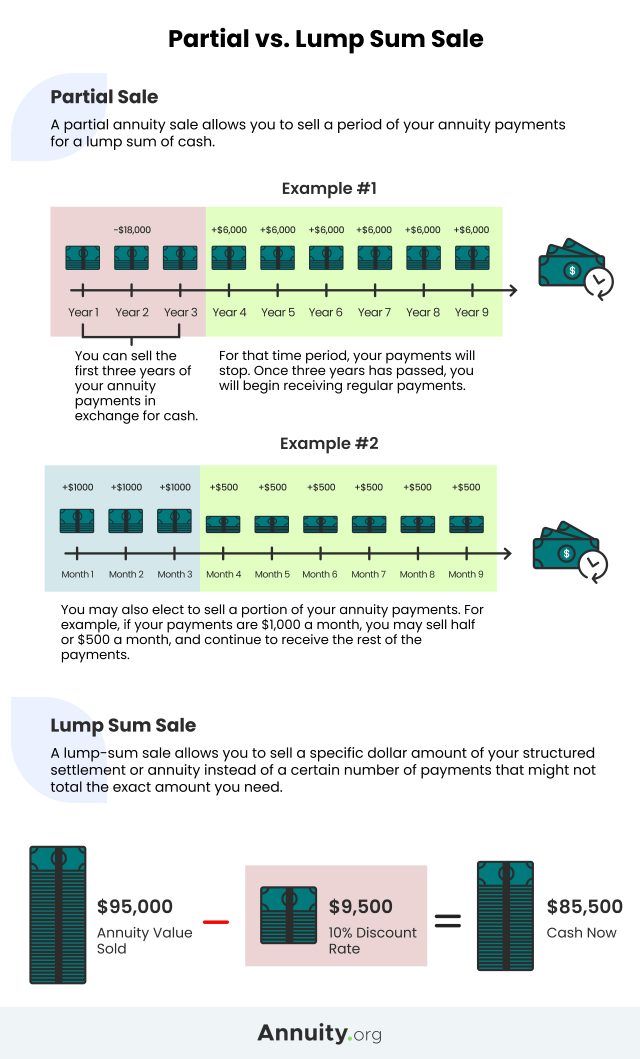

Read our free guide discover 6 sources of post-retirement income you ought to know. Let us discuss some of the major differences between Annuity vs Lump Sum. Annuity refers to a fixed payment on a regular basis which can be monthly or quarterly or on any other basis as per the contract whereas lump sum.

The former provides an immediate up-front amount say 300000 but the pension. Searching Smarter with Us. DistributeResultsFast Is The Newest Place to Search.

DistributeResultsFast Is The Newest Place to Search. Annuities are often complex retirement investment products. PBGC pays lump sums only when a total benefit has a value of 5000 or less.

Not surprisingly the monthly payout will be higher with a single-life annuity than if you opt for the joint-and-survivor benefit because the expected payment period is longer. After the date of your first payment you cannot. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

Read the Other Advantages an Income Annuity Provides How You Can Benefit from One Today. Ad Learn More about How Annuities Work from Fidelity. Ad Want to Learn More About Annuities.

Single life annuities are an attractive annuity payout option because they. Learn some startling facts. Annuity vs Lump Sum.

Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

Income Annuities Immediate And Deferred Seeking Alpha

What Are The Types Of Annuities Quora

Strategies To Maximize Pension Vs Lump Sum Decisions

Preparing For Retirement Faq Company Pensions Irish Life Corporate Business

Lottery Winner S Dilemma Lump Sum Or Annuity

Pension Annuity Vs Lump Sum Which One Is Best

Lottery Payout Options Annuity Vs Lump Sum

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Should You Take The Annuity Or The Lump Sum If You Win The Lottery

How To Pick Your Retirement Date To Optimize Your Chevron Pension

What You Need To Know About A Lump Sum Life Insurance Payout Sproutt

How Much Income Do Annuities Pay Due

Lump Sum Structured Settlement Pension Annuity Money Png 564x632px Lump Sum Annuity Area Brand Finance Download

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Cashing Out Your Retirement Plan Lump Sum Or Annuity Sound Mind Investing

Income Annuities Immediate And Deferred Seeking Alpha

When Can You Cash Out An Annuity Getting Money From An Annuity